USA100 Weekly Special Report based on 1.00 Lot Calculation:

USA100 INDEX:

- WHAT IS A STOCK INDEX: According to Investopedia.com, a stock index measures the price performance of a basket (group) of stocks using a standardized methodology. The NASDAQ 100 Index is one of the world's best-known indexes and one of the most commonly used benchmarks for the stock market.

- COMPONENTS: USA100 includes 100 companies including Apple, Google, Nvidia, Meta, and Microsoft.

RECENT TREND:

- THE NASDAQ 100 IS NOW UP MORE THAN 80% FROM ITS OCTOBER 2022 LOWS: The Nasdaq has sharply rallied from October 2022 lows, as the tech sector continues to remain the best-performing sector in the United States. The Nasdaq rally has outpaced both the S&P500 and the Dow Jones Industrial index since October 2022.

US FEDERAL RESERVE HAS BEGUN YET ANOTHER INTEREST RATE CUT CYCLE:

- BREAKING (SEPTEMBER 18): FEDERAL RESERVE ANNOUNCED ITS FIRST INTEREST RATE CUT SINCE 2020. US Federal Reserve decided to cut its benchmark interest rate by 0.50% points on September 18, to 5.00% from the previous 5.50%. The bank expects to cut rates two more times in 2024 to slash its benchmark rate to 4.5% by the end of 2024. The bank expects rates to fall to 3.5% in 2025 and further down to 2.9% in 2026. NEXT FED INTEREST RATE DECISION: November 7, 2024. As of October 7, the market sees a high probability rate for a 25-basis points interest rate cut. This could bring current rates of 5.00% down to 4.75%.

NEXT ECONOMIC EVENTS:

- THURSDAY, OCTOBER 10 AT 13:30 GMT+1: US INFLATION (CPI) (SEPTEMBER). US Inflation has continued falling in the US with August’s CPI showing a rate of 2.5% (down from previous 2.9%), which was the lowest rate since April 2021. Analysts expect to see a further decline in September to 2.3%. Falling inflation combined with a worsening labor market in the USA has recently increased the chances for continues interest rate cuts at the Fed meetings head, including the next one in November.

NEXT COMPANY EVENTS:

- US STOCK MARKET: Q3 EARNINGS SEASON

OCTOBER 11- NOVEMBER 15. The new earnings season in the US is expected to kick off with the banking sector in mid-October, while some large companies such as Tesla, Meta, Microsoft, Apple, Amazon are expected to report their Q3 earnings results by the end of October.

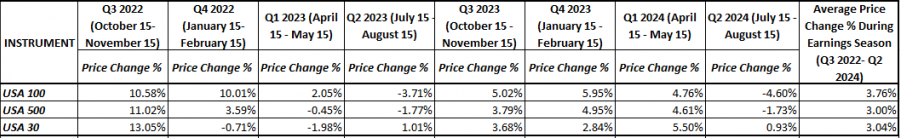

LAST EIGHT QUARTERLY EARNINGS SEASONS: THE ARTIFICIAL INTELLIGENCE (A.I.) EUPHORIA HAS CREATED ON AVERAGE A 3.76% INCREASE FOR THE USA100 DURING THE EARNINGS SEASONS. The table below illustrates price reactions of the three major US stock indices. On average, the USA100 index has risen by 3.76% each quarterly earnings season since Q3 2022. Over the same period, the USA500 index rose 3.00%, while the USA30 index climbed around 3.04%.

Data Source: MetaTrader 4 Platform

Please note that past performance does not guarantee future results

USA100, October 7, 2024

Current Price: 20,100

|

USA100 |

Weekly |

|

Trend direction |

|

|

21,500 |

|

|

21,000 |

|

|

20,600 |

|

|

19,650 |

|

|

19,500 |

|

|

19,350 |

Example of calculation based on weekly trend direction for 1.00 Lot1

|

USA100 |

||||||

|

Profit or loss in $ |

14,000 |

9,000 |

5,000 |

-4,500 |

-6,000 |

-7,500 |

|

Profit or loss in €² |

12,749 |

8,196 |

4,553 |

-4,098 |

-5,464 |

-6,830 |

|

Profit or loss in £² |

10,700 |

6,878 |

3,821 |

-3,439 |

-4,586 |

-5,732 |

|

Profit or loss in C² |

19,013 |

12,223 |

6,790 |

-6,111 |

-8,148 |

-10,186 |

1. 1.00 lot is equivalent of 10 units

2. Calculations for exchange rate used as of 13:00 (GMT+1) 07/10/2024

There is a possibility to use Stop-Loss and Take-Profit.

- You may wish to consider closing your position in profit, even if it is lower than suggested one.

- Trailing stop technique could protect the profit.