USA100 Weekly Special Report based on 1.00 Lot Calculation:

USA100 INDEX:

- WHAT IS A STOCK INDEX: According to Investopedia.com, a stock index measures the price performance of a basket (group) of stocks using a standardized methodology. The NASDAQ 100 Index is one of the world's best-known indexes and one of the most commonly used benchmarks for the stock market.

- COMPONENTS: USA100 includes 100 companies including Apple, Google, Nvidia, Meta, and Microsoft.

US PRESIDENTIAL ELECTIONS (NOVEMBER 5, 2024): US STOCK MARKET TENDS TO RISE AFTER US PRESIDENTIAL ELECTIONS

CANDIDATES: DONALD TRUMP (Republican) vs. KAMALA HARRIS (Democrat).

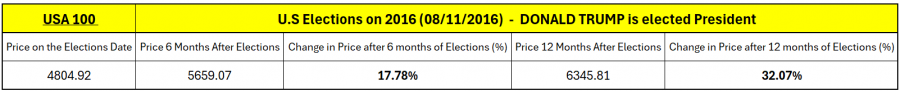

- STATISTICS (DONALD TRUMP WON IN 2016): USA100 ROSE 17.78% WITHIN 6 SIX MONTHS AND 32.07% WITHIN 12 MONTHS AFTER ELECTIONS.

Data Source: Bloomberg

Please note that past performance does not guarantee future results.

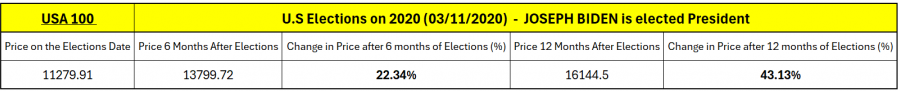

- STATISTICS (JOSEPH BIDEN WON IN 2020 WITH KAMALA HARRIS AS VICE PRESIDENT): USA100 ROSE 22.34% WITHIN 6 SIX MONTHS AND 43.13% WITHIN 12 MONTHS AFTER ELECTIONS.

Data Source: Bloomberg

Please note that past performance does not guarantee future results.

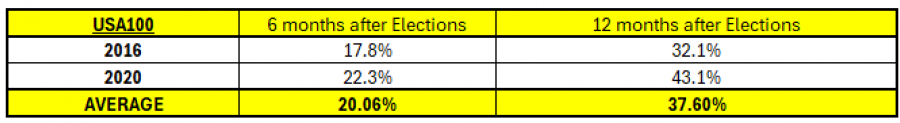

- STATISTICS: USA100 ROSE 20.06% ON AVERAGE WITHIN 6 MONTHS AFTER ELECTIONS, AND 37.60% WITHIN 12 MONTHS AFTER ELECTIONS WHEN DONALD TRUMP OR KAMALA HARRIS ARE INVOLVED. Donald Trump was elected 45th President of the USA in 2016, while Kamala Harris was elected Vice President in the Biden administration in 2020.

Data Source: Bloomberg

Please note that past performance does not guarantee future results.

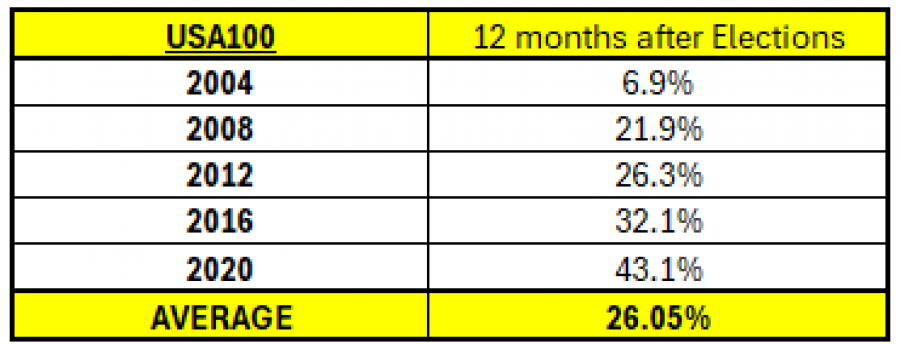

- STATISTICS (STOCK MARKET PERFORMANCE AFTER US PRESIDENTIAL ELECTIONS SINCE 2000): USA100 ROSE 26.05% ON AVERAGE WITHIN 12 MONTHS AFTER ELECTIONS. We have had 5 elections since 2004 and according to the statistics on average the US stock market could rise within the 12 months after each election. Regarding the USA100 index, an average of 26.05% increase could be noted. However, the price could decline further.

Data Source: Bloomberg

Please note that past performance does not guarantee future results.

OTHER EVENTS:

- (THURSDAY, NOVEMBER 7 AT 19:00 GMT): FEDERAL RESERVE MEETING (INTEREST RATE DECISION). As of November 4, the market sees higher chances for 25 basis points interest rates cut. This could bring current rates of 5.00% down to 4.75%.

USA100, November 4, 2024

Current Price: 20,180

|

USA100 |

Weekly |

|

Trend direction |

|

|

25,000 |

|

|

22,600 |

|

|

20,800 |

|

|

19,700 |

|

|

19,500 |

|

|

19,300 |

Example of calculation based on weekly trend direction for 1.00 Lot1

|

USA100 |

||||||

|

Pivot Points |

||||||

|

Profit or loss in $ |

48,200.00 |

24,200.00 |

6,200.00 |

-4,800.00 |

-6,800.00 |

-8,800.00 |

|

Profit or loss in €² |

44,227.49 |

22,205.50 |

5,689.01 |

-4,404.40 |

-6,239.56 |

-8,074.73 |

|

Profit or loss in £² |

37,148.93 |

18,651.54 |

4,778.49 |

-3,699.48 |

-5,240.93 |

-6,782.38 |

|

Profit or loss in C$² |

67,058.07 |

33,668.16 |

8,625.73 |

-6,677.98 |

-9,460.47 |

-12,242.97 |

1. 1.00 lot is equivalent of 10 units

2. Calculations for exchange rate used as of 10:10 (GMT) 04/11/2024

There is a possibility to use Stop-Loss and Take-Profit.

- You may wish to consider closing your position in profit, even if it is lower than suggested one.

- Trailing stop technique could protect the profit.