USA100 Weekly Special Report based on 1.00 Lot Calculation:

USA100 INDEX:

- WHAT IS A STOCK INDEX: According to Investopedia.com, a stock index measures the price performance of a basket (group) of stocks using a standardized methodology. The NASDAQ 100 Index is one of the world's best-known indexes and one of the most commonly used benchmarks for the stock market.

- COMPONENTS: USA100 includes 100 companies, many of them dealing with tech and A.I., such as Apple, Google, ARM, Nvidia, Meta, Microsoft, Amazon, etc.

GEOPOLITICS: US PRESIDENT DONALD TRUMP OFFERS FLEXIBILITY WITH TARIFFS

- RECIPROCAL TARIFF PLAN LESS SEVERE THAN PREVIOUSLY THOUGHT: According to the CNBC, President Donald Trump said there will be flexibility on his reciprocal tariff plan.

- E.U. DELAYED RETALIATORY TARIFFS ON U.S. GOODS TO MID-APRIL (MARCH 20). The European Union has delayed its first counter-measures against the United States over President Donald Trump's metals tariffs until mid-April, allowing it to re-think which U.S. goods to hit and offering extra weeks for negotiations. (Source: Reuters)

- EVENT (MARCH 25-MARCH 29): U.S. - INDIA NEW TRADE DEAL TALKS. A delegation of officials from the United States will visit India from March 25-29 for trade talks with Indian officials. Assistant U.S. Trade Representative for South and Central Asia Brendan Lynch will lead the group. (Source: Reuters)

US PRESIDENT DONALD TRUMP AND HIS IMPACT ON THE US STOCK MARKET:

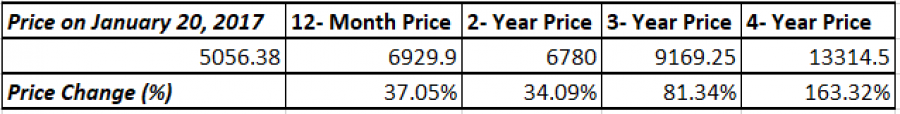

- STATISTICS (USA 100 INDEX DURING TRUMP’S FIRST TERM (2017 – 2021)): USA100 INDEX ROSE 37.05% WITHIN THE FIRST 12 MONTHS FOLLOWING DONALD TRUMP'S INAUGURATION AS 45TH U.S. PRESIDENT (January 20, 2017 – January 20, 2018). In addition, the USA100 index rose 163.32% during the entire first term of Donald Trump’s service as 45th President of the USA.

Data Source: MetaTrader 4 Platform

Please note that past performance does not guarantee future results

US FEDERAL RESERVE HAS BEGUN YET ANOTHER INTEREST RATE CUT CYCLE:

- BREAKING (MARCH 19): FED SIGNALS MORE RATE CUTS AHEAD, BOOSTING TECH SENTIMENT. The US Federal Reserve kept its benchmark interest rate steady at 4.50%. However, Jerome Powell reaffirmed the Fed’s projection of two rate cuts in 2025, and signaled that inflation is gradually coming under control.

- NEXT FED INTEREST RATE DECISION: May 7, 2025. Markets have recently raised their expectations for three interest rate cuts in 2025, which could eventually bring rates down to 3.75% from the current 4.5% (Source: CMEGROUP.COM).

BIG TECH’S MASSIVE A.I. SPENDING IN 2025 AND BEYOND

- Meta (Facebook), Alphabet (Google), Microsoft, Amazon, Apple, Taiwan Semiconductor Manufacturing and more plan to invest over billions of dollars in capital expenditures this year and beyond, with a strong focus on A.I. and cloud infrastructure:

- Meta (Facebook): ~$65 billion

- Alphabet (Google): ~$80 billion

- Microsoft: ~$85 billion

- Amazon: ~$120 billion

- Apple: ~ $500 billion

- Taiwan Semiconductors Manufacturing: ~ $100 billion

- These investments are expected to further strengthen A.I. development, benefiting semiconductor and cloud-based service providers.

PRICE ACTION:

- USA100 HAS TESTED ITS LOWEST PRICE IN SIX MONTHS (19,142.50). The index has recently retreated from its all-time high of 22,448.90, hitting its lowest rate in 6 months on March 11, 2025 (19,142.50).

- USA100 INDEX HIT AN ALL-TIME HIGH OF 22,448.90 (DECEMBER 16, 2024). The index has traded around 20,200 and if a full recovery takes place, USA100 could rise around 11%. Although, the index could decline in price as well.

USA100, March 24, 2025

Current Price: 20,200

|

USA100 |

Weekly |

|

Trend direction |

|

|

22,450 |

|

|

21,600 |

|

|

20,800 |

|

|

19,700 |

|

|

19,400 |

|

|

19,200 |

Example of calculation based on weekly trend direction for 1.00 Lot1

|

USA100 |

||||||

|

Profit or loss in $ |

22,500 |

14,000 |

6,000 |

-5,000 |

-8,000 |

-10,000 |

|

Profit or loss in €² |

20,769 |

12,923 |

5,538 |

-4,615 |

-7,384 |

-9,230 |

|

Profit or loss in £² |

17,377 |

10,812 |

4,634 |

-3,862 |

-6,179 |

-7,723 |

|

Profit or loss in C² |

32,213 |

20,044 |

8,590 |

-7,159 |

-11,454 |

-14,317 |

1. 1.00 lot is equivalent of 10 units

2. Calculations for exchange rate used as of 10:20 (GMT) 24/03/2025

There is a possibility to use Stop-Loss and Take-Profit.

- You may wish to consider closing your position in profit, even if it is lower than suggested one.

- Trailing stop technique could protect the profit.