USA100 Weekly Special Report based on 1.00 Lot Calculation:

USA100 INDEX:

- WHAT IS A STOCK INDEX: According to Investopedia.com, a stock index measures the price performance of a basket (group) of stocks using a standardized methodology. The NASDAQ 100 Index is one of the world's best-known indexes and one of the most commonly used benchmarks for the stock market.

- COMPONENTS: USA100 includes 100 companies, many of them dealing with tech and A.I., such as Apple, Google, ARM, Nvidia, Meta, Microsoft, Amazon, etc.

US TARIFFS: TRUMP’S RECIPROCAL TARIFFS.

- BREAKING (APRIL 9): US PRESIDENT TRUMP SUSPENDED THEIR RECIPROCAL TARIFFS ON THE REST OF THE WORLD BY 90 DAYS. For the next 90 days, the US will charge countries that are part of the reciprocal tariff plan only 10%, compared to the range of up to 84% previously planned, as it gives time and space other countries to begin and reach new trade deals with the USA. More than 70 countries have already contacted the US administration to begin talks soon. This has significantly reduced global recession fears.

US PRESIDENT DONALD TRUMP AND HIS IMPACT ON THE US STOCK MARKET:

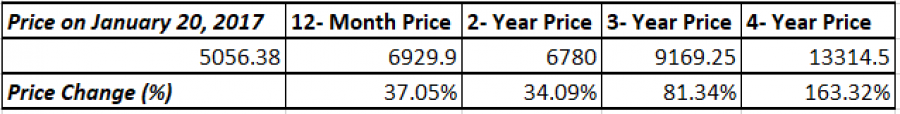

- STATISTICS (USA 100 INDEX DURING TRUMP’S FIRST TERM (2017 – 2021)): USA100 INDEX ROSE 37.05% WITHIN THE FIRST 12 MONTHS FOLLOWING DONALD TRUMP'S INAUGURATION AS 45TH U.S. PRESIDENT (January 20, 2017 – January 20, 2018). In addition, the USA100 index rose 163.32% during the entire first term of Donald Trump’s service as 45th President of the USA.

Data Source: MetaTrader 4 Platform

Please note that past performance does not guarantee future results

U.S. Q1 EARNINGS SEASON (April 11 – May 15):

- BANKING SECTOR TO BEGIN THE SEASON: JPMorgan, Morgan Stanley, and Wells Fargo are expected to report their Q1 earnings on April 11.

- TECHNOLOGY COMPANIES TO BE IN THE SPOTLIGHT: Tesla, Microsoft, Facebook, Amazon, Apple, Google, and Netflix will all report their Q1 earnings results and projections for future quarters in late April or early May. Major USA 100 companies plan to invest billions of dollars in capital expenditures this year and beyond, with a strong focus on A.I. and cloud infrastructure. Apple leads with an estimated $500 billion in investments, followed by Amazon ($120B), TSMC ($100B), Microsoft ($85B), Alphabet ($80B), and Meta ($65B). These investments are expected to further strengthen A.I. development, benefiting semiconductor and cloud-based service providers.

THE US FEDERAL RESERVE HAS BEGUN YET ANOTHER INTEREST RATE CUT CYCLE:

- FEDERAL RESERVE INTEREST RATE AT 4.5%. The US Federal Reserve decided to cut its benchmark interest rate by 0.50% points in September, 0.25% points in November, and 0.25% in December to bring interest rates down from the previous 5.5% to the current 4.5%.

- NEXT FED INTEREST RATE DECISION: May 7, 2025.

PRICE ACTION:

- USA100 INDEX HIT AN ALL-TIME HIGH OF 22,448.90 (DECEMBER 16, 2024). The index has traded around 18,850 and if a full recovery takes place, USA100 could rise around 19%. Although, the index could decline in price as well.

- USA100 HAS TESTED ITS LOWEST PRICE IN 15 MONTHS (16,459). The index has recently retreated from its all-time high of 22,448.90, hitting its lowest rate in 15 months, on April 7, 2025 (16,459).

USA100, April 10, 2025

Current Price: 18,850

|

USA100 |

Weekly |

|

Trend direction |

|

|

22,450 |

|

|

21,000 |

|

|

19,850 |

|

|

18,000 |

|

|

17,700 |

|

|

17,500 |

Example of calculation based on weekly trend direction for 1.00 Lot1

|

USA100 |

||||||

|

Profit or loss in $ |

36,000 |

21,500 |

10,000 |

-8,500 |

-11,500 |

-13,500 |

|

Profit or loss in €² |

32,629 |

19,487 |

9,064 |

-7,704 |

-10,423 |

-12,236 |

|

Profit or loss in £² |

27,960 |

16,698 |

7,767 |

-6,602 |

-8,932 |

-10,485 |

|

Profit or loss in C² |

50,710 |

30,285 |

14,086 |

-11,973 |

-16,199 |

-19,016 |

1. 1.00 lot is equivalent of 10 units

2. Calculations for exchange rate used as of 09:30 (GMT+1) 10/04/2025

There is a possibility to use Stop-Loss and Take-Profit.

- You may wish to consider closing your position in profit, even if it is lower than suggested one.

- Trailing stop technique could protect the profit.