USA30 Weekly Special Report based on 1.00 Lot Calculation:

- WHAT IS A STOCK INDEX: According to Investopedia.com, a stock index measures the price performance of a basket (group) of stocks using a standardized metric and methodology. The Dow Jones (USA30) is one of the world's best-known indexes and one of the most commonly used benchmarks for the stock market.

- COMPONENTS: USA30 includes 30 companies such as Amazon, Boeing, JPMorgan, Nike, Walmart, Coca-Cola and etc.

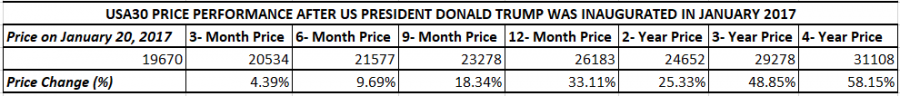

US PRESIDENT DONALD TRUMP AND HIS IMPACT ON THE US STOCK MARKET:

- STATISTICS (US STOCKS DURING TRUMP’S FIRST TERM (2017 – 2021)): USA30 INDEX ROSE 33.11% WITHIN THE FIRST 12 MONTHS FOLLOWING DONALD TRUMP'S INAUGURATION AS 45TH U.S. PRESIDENT (January 20, 2017 – January 20, 2018). In addition, the USA30 index rose 58.15% during the entire first term of Donald Trump’s service as 45th President of the USA.

Data Source: MetaTrader 4 Platform

Please note that past performance does not guarantee future results.

US FEDERAL RESERVE HAS BEGUN YET ANOTHER INTEREST RATE CUT CYCLE:

- FEDERAL RESERVE INTEREST RATE AT 4.5%. The US Federal Reserve decided to cut its benchmark interest rate by 0.50% points in September, 0.25% points in November, and 0.25% in December. The bank expects to cut rates two more times in 2025 to slash its benchmark rate to 4% by the end of 2025. The bank expects rates to fall to 3.40% in 2026 and further down to 3.10% in 2027.

- NEXT FED INTEREST RATE DECISION: March 19, 2025. Markets have recently raised their expectations for three interest rate cuts in 2025, which could eventually bring rates down to 3.75% from the current 4.5% (Source: CMEGROUP.COM).

EVENTS:

- WEDNESDAY, MARCH 12, at 12:30 GMT: U.S INFLATION (CPI) (FEBRUARY): The U.S is scheduled to report its CPI figure for the month of February. Headline Inflation is expected to come in at 2.9%, down from the previous 3%. Core Inflation is expected to come in at 3.2%, down from the previous 3.3%.

PRICE ACTION:

- USA30 HAS TESTED ITS LOWEST PRICE IN SIX MONTHS (41,218). The index has recently retreated from its all-time high of 45,224, hitting its lowest rate in 6 months on March 11, 2025 (41218).

- USA30 INDEX HIT AN ALL-TIME HIGH OF 45,224 (JANUARY 31, 2025). The index has traded around 41,600 and if a full recovery takes place, USA30 could rise around 9.0%. Although, the index could decline in price as well.

USA30, March 12, 2025

Current Price: 41,600

|

USA30 |

Weekly |

|

Trend direction |

|

|

45,224 |

|

|

44,200 |

|

|

42,600 |

|

|

40,700 |

|

|

40,350 |

|

|

40,000 |

Example of calculation base on weekly trend direction for 1.00 Lot1

|

USA30 |

||||||

|

Profit or loss in $ |

36,240 |

26,000 |

10,000 |

-9,000 |

-12,500 |

-16,000 |

|

Profit or loss in €² |

33,214 |

23,829 |

9,165 |

-8,249 |

-11,456 |

-14,664 |

|

Profit or loss in £² |

28,007 |

20,093 |

7,728 |

-6,955 |

-9,660 |

-12,365 |

|

Profit or loss in C$² |

52,299 |

37,521 |

14,431 |

-12,988 |

-18,039 |

-23,090 |

1. 1.00 lot is equivalent of 10 units

2. Calculations for exchange rate used as of 10:30 (GMT) 12/03/2025

There is a possibility to use Stop-Loss and Take-Profit.

- You may wish to consider closing your position in profit, even if it is lower than suggested one.

- Trailing stop technique could protect the profit.