USA30 Weekly Special Report based on 1.00 Lot Calculation:

USA30 INDEX:

- WHAT IS A STOCK INDEX: According to Investopedia.com, a stock index measures the price performance of a basket (group) of stocks using a standardized metric and methodology. The Dow Jones (USA30) is one of the world's best-known indexes and one of the most commonly used benchmarks for the stock market.

- COMPONENTS: USA30 includes 30 companies such as Amazon, Boeing, JPMorgan, Nike, Walmart, Coca-Cola and etc.

US PRESIDENT DONALD TRUMP AND HIS IMPACT ON THE US STOCK MARKET:

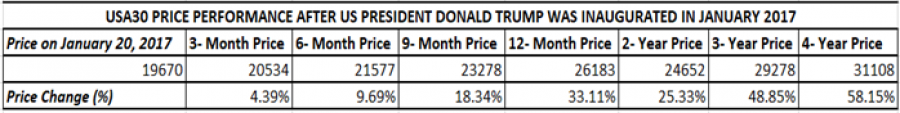

- STATISTICS (US STOCKS DURING TRUMP’S FIRST TERM (2017 – 2021)): USA30 INDEX ROSE 33.11% WITHIN THE FIRST 12 MONTHS FOLLOWING DONALD TRUMP'S INAUGURATION AS 45TH U.S. PRESIDENT (January 20, 2017 – January 20, 2018). In addition, the USA30 index rose 58.15% during the entire first term of Donald Trump’s service as 45th President of the USA.

Data Source: MetaTrader 4 Platform

Please note that past performance does not guarantee future results.

US FEDERAL RESERVE HAS BEGUN YET ANOTHER INTEREST RATE CUT CYCLE:

- FEDERAL RESERVE INTEREST RATE AT 4.5%. The US Federal Reserve decided to cut its benchmark interest rate by 0.50% points in September, 0.25% points in November, and 0.25% in December. The bank expects to cut rates two more times in 2025 to slash its benchmark rate to 4% by the end of 2025. The bank expects rates to fall to 3.40% in 2026 and further down to 3.10% in 2027.

- NEXT FED INTEREST RATE DECISION: May 7, 2025. Markets have recently raised their expectations for three interest rate cuts in 2025, which could eventually bring rates down to 3.75% from the current 4.5% (Source: CMEGROUP.COM).

EVENTS:

- TUESDAY, MARCH 25 AT 14:00 GMT: US CB CONSUMER CONFIDENCE (MARCH). The US consumer sentiment has been lately monitored closely by investors as it gives indications about future near-term economic outlook, especially with the ongoing trade wars. Data for February printed the lowest figures since June 2024, coming in at 98.3, below estimated 102.7.

- THURSDAY, MARCH 27, AT 12:30 GMT: GROSS DOMESTIC PRODUCT (GDP) (Q4): A lower-than-expected reading should be taken as positive for silver, because it will push the FED to lower interest rates to stimulate the economy. GDP measures the annualized change in the inflation – adjusted value of all goods and services produced by the economy. This is the last reading for Q4 GDP in the USA. The previous reading for Q4 reported in February was 2.3%.

- FRIDAY, MARCH 28, AT 12:30 GMT: US PERSONAL CONSUMPTION EXPENDITURES (PCE) PRICE INDEX (FEBRUARY): A fall in this index could point to the FED cutting interest rates sooner, which is supportive for silver. Data for January came in at 2.5%, down from December’s 2.6%.

PRICE ACTION:

- USA30 HAS TESTED ITS LOWEST PRICE IN SIX MONTHS (40,706). The index has recently retreated from its all-time high of 45,224, hitting its lowest rate in 6 months on March 13, 2025 (40,706).

- USA30 INDEX HIT AN ALL-TIME HIGH OF 45,224 (JANUARY 31, 2025). The index has traded around 42,100 and if a full recovery takes place, USA30 could rise around 7%. Although, the index could decline in price as well.

USA30, March 21, 2025

Current Price: 42,100

|

USA30 |

Weekly |

|

Trend direction |

UP |

|

45,200 |

|

|

44,100 |

|

|

43,100 |

|

|

41,200 |

|

|

40,950 |

|

|

40,700 |

Example of calculation base on weekly trend direction for 1.00 Lot1

|

USA30 |

||||||

|

Profit or loss in $ |

31,000 |

20,000 |

10,000 |

-9,000 |

-11,500 |

-14,000 |

|

Profit or loss in €² |

28,620 |

18,464 |

9,232 |

-8,309 |

-10,617 |

-12,925 |

|

Profit or loss in £² |

23,961 |

15,458 |

7,729 |

-6,956 |

-8,889 |

-10,821 |

|

Profit or loss in C$² |

44,423 |

28,660 |

14,330 |

-12,897 |

-16,480 |

-20,062 |

1. 1.00 lot is equivalent of 10 units

2. Calculations for exchange rate used as of 10:30 (GMT) 21/03/2025

There is a possibility to use Stop-Loss and Take-Profit.

- You may wish to consider closing your position in profit, even if it is lower than suggested one.

- Trailing stop technique could protect the profit.