USA30 Weekly Special Report based on 1.00 Lot Calculation:

USA30 INDEX:

- WHAT IS A STOCK INDEX: According to Investopedia.com, a stock index measures the price performance of a basket (group) of stocks using a standardized metric and methodology. The Dow Jones (USA30) is one of the world's best-known indexes and one of the most commonly used benchmarks for the stock market.

- COMPONENTS: USA30 includes 30 companies such as Amazon, Boeing, JPMorgan, Nike, Walmart, Coca-Cola etc.

GEOPOLITICS: US TRADE NAGOTIATIONS HAVE BEGUN?

- NEWS (APRIL 9): US PRESIDENT TRUMP SUSPENDED THEIR RECIPROCAL TARIFFS ON THE REST OF THE WORLD BY 90 DAYS. For the next 90 days, the US will charge countries that are part of the reciprocal tariff plan only 10%, compared to the range of up to 84% previously planned, as it gives time and space for other countries to begin and reach new trade deals with the USA. More than 70 countries have already contacted the US administration to begin talks soon. This has significantly reduced global recession fears.

- SOME TRADE NEGOTIATIONS HAVE ALREADY BEGUN: US President Donald Trump himself joined the talks with Japan on April 16, showing how important it is to him and the USA to get new trade deals. According to the Associated Press, Donald Trump attended the meeting alongside Treasury Secretary Scott Bessent and Commerce Secretary Howard Lutnick, top economic advisers with a central role in his trade and tariff policies.

U.S. Q1 EARNINGS SEASON (April 11 – May 15):

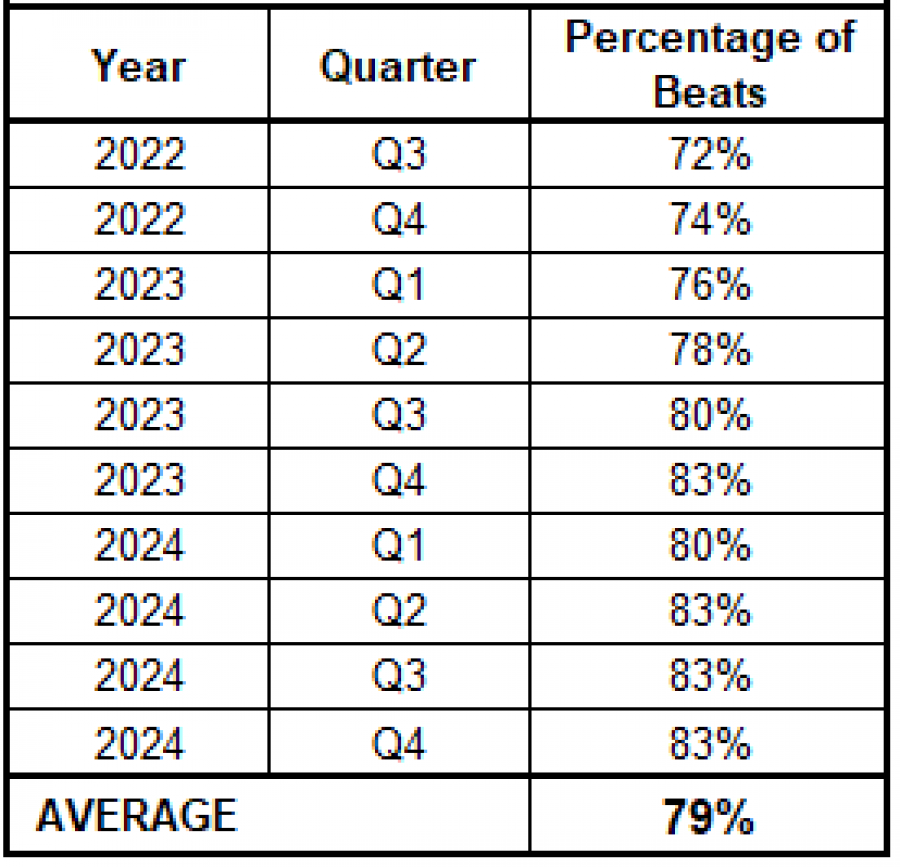

- USA30 INDEX COMPANIES DURING LAST 10 QUARTERLY EARNINGS SEASONS: 79% OF THE COMPANIES ON AVERAGE HAVE BEAT EARNINGS ESTIMATES. When a company exceeds earnings expectations, it signals stronger than anticipated performance, boosting investor confidence.

Data Source: Reuters, CNBC, Bloomberg, Google

Please note that past performance does not guarantee future results

- Q1 EARNINGS CALENDAR: Q1 Earnings Report dates for some of the most well-known tech companies in the world

- MICROSOFT: 30/04/2025 - AFTERMARKET

- META (FACEBOOK): 30/04/2025 – AFTERMARKET

- AMAZON: 01/05/2025 - AFTERMARKET

- APPLE: 01/05/2025 - AFTERMARKET

- NVIDIA: 28/05/2025 – AFTERMARKET

EVENTS:

- FRIDAY, MAY 2, AT 13:30 GMT+1: US NONFARM PAYROLLS (NFP) AND UNEMPLOYMENT RATE (APRIL): The U.S. labor market report will be in focus. In March, NFPs came in at 228K and the unemployment rate rose to 4.2% from the previous 4.1%. If the unemployment rate keeps the upward trend (4% in January, 4.1% in February, and 4.2% in March), it could lead to a more aggressive interest rate cut policy by the US Federal Reserve, which in turn could potentially support the USA30 Index. Although, prices could fall as well.

PRICE ACTION:

- THE USA30 INDEX HIT AN ALL-TIME HIGH OF 45,224 (JANUARY 31, 2025). The index has traded around 39,900 and if a full recovery takes place, USA30 could rise around 13%. Although, the index could decline in price as well.

- THE USA30 INDEX HAS TESTED ITS LOWEST PRICE IN 15 MONTHS (36,707). The index has recently retreated from its all-time high of 45,224, hitting its lowest rate in 15 months, on April 6, 2025 (36,707).

USA30, April 23, 2025

Current Price: 40,000

|

USA30 |

Weekly |

|

Trend direction |

|

|

45,220 |

|

|

43,200 |

|

|

41,200 |

|

|

38,900 |

|

|

38,500 |

|

|

38,000 |

Example of calculation base on weekly trend direction for 1.00 Lot1

|

USA30 |

||||||

|

Profit or loss in $ |

52,200 |

32,000 |

12,000 |

-11,000 |

-15,000 |

-20,000 |

|

Profit or loss in €² |

45,657 |

27,989 |

10,496 |

-9,621 |

-13,120 |

-17,493 |

|

Profit or loss in £² |

39,151 |

24,001 |

9,000 |

-8,250 |

-11,250 |

-15,000 |

|

Profit or loss in C$² |

72,036 |

44,160 |

16,560 |

-15,180 |

-20,700 |

-27,600 |

1. 1.00 lot is equivalent of 10 units

2. Calculations for exchange rate used as of 10:00 (GMT) 23/04/2025

There is a possibility to use Stop-Loss and Take-Profit.

- You may wish to consider closing your position in profit, even if it is lower than suggested one.

- Trailing stop technique could protect the profit.