USA500 Weekly Special Report based on 1.00 Lot Calculation:

USA500 INDEX:

- WHAT IS A STOCK INDEX: According to Investopedia.com, a stock index measures the price performance of a basket (group) of stocks using a standardized methodology. The S&P 500 Index is one of the world's best-known indexes and one of the most commonly used benchmarks for the stock market.

- COMPONENTS: USA500 includes 500 companies, including Tesla, Apple, Google, Nvidia, Meta, and Goldman Sachs.

GEOPOLITICS: US PRESIDENT DONALD TRUMP OFFERS FLEXIBILITY WITH TARIFFS

- RECIPROCAL TARIFF PLAN LESS SEVERE THAN PREVIOUSLY THOUGHT: According to the CNBC, President Donald Trump said there will be flexibility on his reciprocal tariff plan.

- E.U. DELAYED RETALIATORY TARIFFS ON U.S. GOODS TO MID-APRIL (MARCH 20). The European Union has delayed its first counter-measures against the United States over President Donald Trump's metals tariffs until mid-April, allowing it to re-think which U.S. goods to hit and offering extra weeks for negotiations. (Source: Reuters)

- EVENT (MARCH 25-MARCH 29): U.S. - INDIA NEW TRADE DEAL TALKS. A delegation of officials from the United States will visit India from March 25-29 for trade talks with Indian officials. Assistant U.S. Trade Representative for South and Central Asia Brendan Lynch will lead the group. (Source: Reuters)

US PRESIDENT DONALD TRUMP AND HIS IMPACT ON THE US STOCK MARKET:

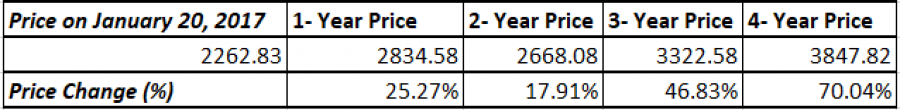

- STATISTICS (US STOCKS DURING TRUMP’S FIRST TERM (2017 – 2021)): USA500 INDEX ROSE 25.27% WITHIN THE FIRST 12 MONTHS FOLLOWING DONALD TRUMP'S INAUGURATION AS 45TH U.S. PRESIDENT (January 20, 2017 – January 20, 2018). In addition, the USA500 index rose 70.04% during the entire first term of Donald Trump’s service as 45th President of the USA.

Data Source: MetaTrader 4 Platform

Please note that past performance does not guarantee future results

PRICE ACTION:

- USA500 INDEX HIT AN ALL-TIME HIGH OF 6,165.82 (FEBRUARY 19, 2025). The index has traded around 5,780 and if a full recovery takes place, USA500 could rise around 7%. Although, the index could decline in price as well.

- USA500 HAS TESTED ITS LOWEST PRICE IN SIX MONTHS (5,509.24). The index has recently retreated from its all-time high of 6,165.82, hitting its lowest rate in 6 months on March 13, 2025 (5,509.24).

OTHER EVENTS:

- FRIDAY, MARCH 28, AT 12:30 GMT: PERSONAL CONSUMPTION EXPENDITURES (PCE) PRICE INDEX (FEBRUARY): A fall in this index could lead to a fall in interest rates which is supportive for US Stocks. This index is a US-wide indicator of the average increase in prices for all domestic personal consumption. The data for the previous month came in at 2.5%, down from January’s 2.6%.

- TUESDAY, APRIL 1, AT 14:00 GMT: US ISM MANUFACTURING PMI (MARCH). The US manufacturing activity has recently improved to return in the expansion territory above the mark of 50. However, if data came in lower for March, it would trigger another alarm at the Fed, urging them to cut rates sooner than later, which could prove positive for US Stocks. Data for February came in at 50.3, below estimated 50.6.

- FRIDAY, APRIL 4, AT 12:30 GMT: US NONFARM PAYROLLS (NFP) AND UNEMPLOYMENT RATE (MARCH). Us Unemployment rose in February after a string of layoffs by Trump’s administration, which sent the unemployment rate up to 4.1% from the previous 4%. The labor market data in the US remained one of the most important reports Fed uses in their interest rate decisions. If the labor market continued to remain under pressure, the Fed then could be expected to cut rates sooner than previously thought. This could prove positive for US Stocks.

USA500, March 24, 2025

Current Price: 5,780

|

USA500 |

Weekly |

|

Trend direction |

|

|

6,200 |

|

|

6,100 |

|

|

5,950 |

|

|

5,620 |

|

|

5,580 |

|

|

5,510 |

Example of calculation based on weekly trend direction for 1.00 Lot1

|

USA500 |

||||||

|

Profit or loss in $ |

4,200 |

3,200 |

1,700 |

-1,600 |

-2,000 |

-2,700 |

|

Profit or loss in €² |

3,881 |

2,957 |

1,571 |

-1,478 |

-1,848 |

-2,495 |

|

Profit or loss in £² |

3,246 |

2,473 |

1,314 |

-1,237 |

-1,546 |

-2,087 |

|

Profit or loss in C² |

6,022 |

4,588 |

2,438 |

-2,294 |

-2,868 |

-3,871 |

1. 1.00 lot is equivalent of 10 units

2. Calculations for exchange rate used as of 10:50 (GMT) 24/03/2025

There is a possibility to use Stop-Loss and Take-Profit.

- You may wish to consider closing your position in profit, even if it is lower than suggested one.

- Trailing stop technique could protect the profit.