Wheat Weekly Special Report based on 1.00 Lot Calculation:

GLOBAL WHEAT MARKET SHARE:

- LARGEST WHEAT PRODUCERS (OF TOTAL PRODUCTION EXPECTED IN 2024/2025: 793.24 MILLION TONES): China at 17%, the European Union at ~17%, India at ~14%, Russia at ~12%, USA at ~6% and Ukraine ~3%.

- LARGEST WHEAT EXPORTERS OF A TOTAL 212.31 MILLION TONS (2024/2025): Russia at 22.62%, the European Union at 14.13%, Canada at 12.25%, Australia at 11.78%, the USA at 10.58%, and Ukraine at 7.54%.

- RUSSIA + UKRAINE SHARE at ~30%: Russia and Ukraine account for nearly one-third of total global exports.

IMPACT OF THE RUSSIA-UKRANIE WAR:

The Russia-Ukraine war has significantly disrupted the global wheat market, as both countries together account for over 30% of global wheat exports. Key effects include:

- SUPPLY DISRUPTIONS: Ukraine’s wheat production and exports declined due to damaged infrastructure, blocked ports, and trade restrictions, while Russia’s export taxes and quotas further tightened global supply.

- PRICE VOLATILITY: Wheat prices surged to record highs in 2022, due to concerns over supply shortages. Food inflation increased globally, particularly in wheat-dependent countries in Africa and the Middle East.

- TRADE ROUTE BLOCKADES: The closure of Black Sea ports forced Ukraine to rely on alternative, less efficient land routes, further increasing costs and logistical challenges.

CURRENT GEOPOLITACAL OUTLOOK:

Recent developments suggest that no peace deal is expected in the short term between Russia and Ukraine:

- US PRESIDENT TRUMP THREATENED RUSSIA IN A SIGN OF LACK OF PROGRESS IN PEACE TALKS: U.S. President Donald Trump said he is “very angry” with President Putin and announced potential secondary tariffs of 25%–50% on buyers of Russian oil, accusing Moscow of blocking efforts to end the war.

- ESCALATING TENSIONS: President Putin publicly questioned the legitimacy of Ukrainian President Zelenskyy, worsening diplomatic relations.

- ONGOING SUPPLY DISRUPTIONS: With no resolution, Ukrainian wheat exports remain limited, supporting elevated risk premiums and supply concerns in global wheat markets.

RECENT PRICE ACTION:

- WHEAT PRICES HIT AN ALL-TIME HIGH OF $1356.50 (MARCH, 2022). Wheat was trading last near $535 and if a full recovery to 2022’s all-time occurs, this could provide an upside of around 153%. Although, prices could fall, too.

TECHNICAL ANALYSIS:

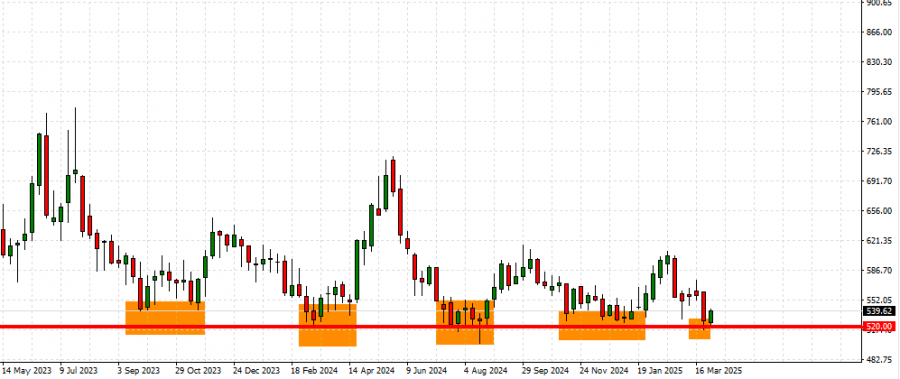

- STRONG SUPPORT AT $520: Since March 2022, Wheat has been predominantly trading above the mark of $520. Wheat has tested the area around $520 four times since March 2022, and every time it would recover to levels toward 600 or above. This is the fifth time in the past two years that Wheat prices have tested levels near $520. (Source: Fortrade Meta Trader 4 Platform).

GRAPH (Weekly): March 2023 – April 2025

Please note that past performance does not guarantee future results.

WHEAT, April 1, 2025

Current Price: 535

|

Wheat |

Weekly |

|

Trend direction |

|

|

720 |

|

|

650 |

|

|

580 |

|

|

495 |

|

|

485 |

|

|

475 |

Example of calculation based on weekly trend direction for 1.00 Lot1

|

WHEAT |

||||||

|

Pivot Points |

||||||

|

Profit or loss in $ |

18,500 |

11,500 |

4,500 |

-4,000 |

-5,000 |

-6,000 |

|

Profit or loss in €2 |

17,152 |

10,662 |

4,172 |

-3,709 |

-4,636 |

-5,563 |

|

Profit or loss in £2 |

14,349 |

8,919 |

3,490 |

-3,102 |

-3,878 |

-4,654 |

|

Profit or loss in C$2 |

26,633 |

16,555 |

6,478 |

-5,758 |

-7,198 |

-8,638 |

1. 1.00 lot is equivalent of 100 units

2. Calculations for exchange rate used as of 11:30 (GMT+1) 01/04/2025

There is a possibility to use Stop-Loss and Take-Profit.

- You may wish to consider closing your position in profit, even if it is lower than suggested one.

- Trailing stop technique could protect the profit.