The Eurodollar declined to a more than two-week low following the European Central Bank’s interest rate cut and U.S. President Donald Trump’s new tariffs on China, Mexico, and Canada.

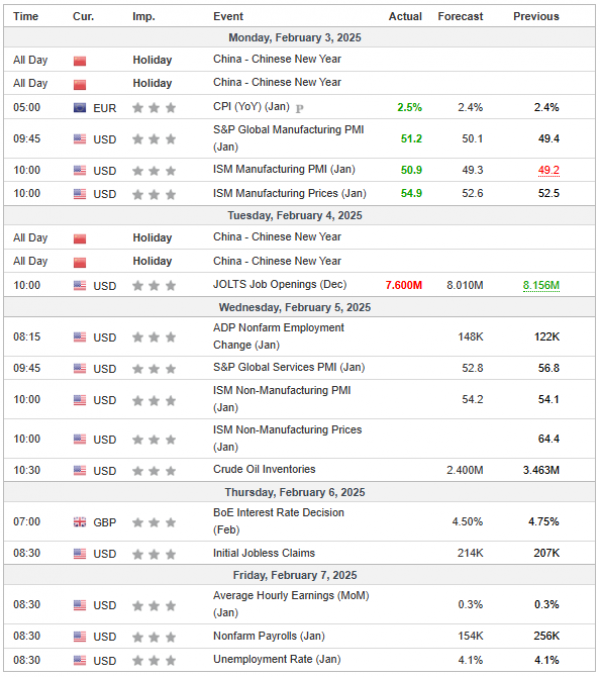

The British pound dropped sharply, ahead of the Bank of England’s interest rate decision, despite stronger-than-expected December inflation figures in the UK as concerns over sluggish UK economic growth persisted.

The USD/JPY pair climbed after the Bank of Japan signaled that further interest rate hikes in the near future are unlikely, following 25-basis-point rate increase to 0.5% in late January.

Gold prices rose to a new all-time high, as investors are switching towards safe heaven assets amid rising global concerns following U.S. President Donald Trump’s new tariff policies to Canada, Mexico and China.

Stock prices rose in the second week of President Trump’s inauguration, with major U.S. indices performing strongly, nearing all-time highs. During earnings season, Meta, Apple, and Microsoft posted blockbuster results, injecting back optimism to the market.

Crude oil prices dropped to a four-week low after President Trump declared a national energy emergency and pledged to boost U.S. oil production. Investors are closely watching Trump’s latest tariff policies as well, which could increase volatility with Crude Oil prices in the coming period.