The Eurodollar edged to a five-month high last week after Europe’s largest economy, Germany, reached an agreement among its government coalition partners for increased spending to boost economic growth.

The British pound inched higher after slightly softer-than-expected US inflation data provided the Fed with room to cut interest rates in the coming months.

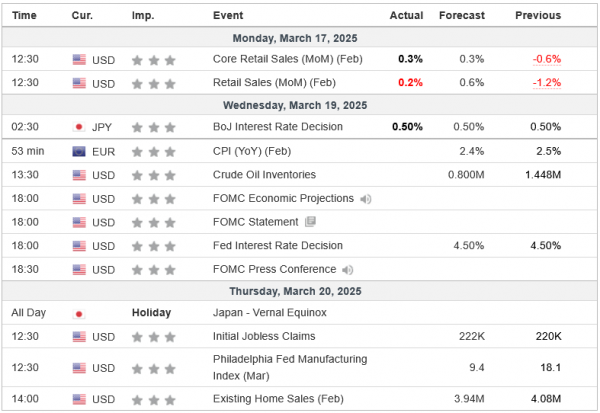

The USD/JPY increased amid high volatility after Bank of Japan Governor Ueda signaled that a rate hike is not expected this Wednesday.

Gold prices jumped to a fresh all-time high, above the three-thousand-dollar level. The US warned Iran that it could use its military against the country after Iran refused to negotiate on a potential nuclear deal.

U.S. stock markets declined and fell into correction territory as fears of a damaging trade war continued after statements from the US administration expressed determination to continue with the tariff policy.

Crude oil prices rose, supported by a cautious response from Russia on the US proposal for a 30-day ceasefire in Ukraine. Falling US inventories also underpinned the commodity.